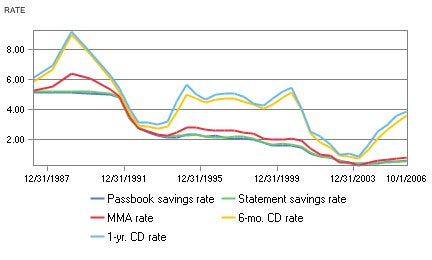

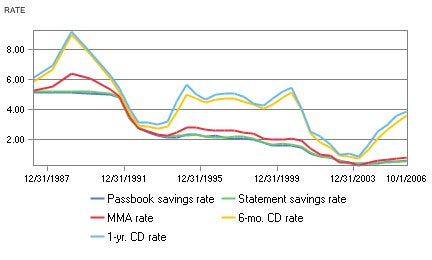

This number peaked at 17 percent in 1975. Please seek a certified professional financial advisor if you need assistance. to figure out how much money you could save over different time periods, figuring in interest. While rates decreased in the following years, banks were still offering around 5% in 1990, significantly higher than the sub-1% rates during the mid-2010s. Then, three-quarters of it were to be spent on a worthy cause while the remainder was to be reinvested for another 100 years. Interest in the savings account compounds daily and posts to your account monthly. The annual average for savings account interest rates in 1990 is reported as being 14.23%, which is insanely high. APY valid as of 02/14/2023. We also include money market accounts if they function like savings accounts. Because they earn zero interest on customer reserve funds, they typically keep them as low as possible. TO EARN APY HIGHLIGHTS. Average interest rate for savings accounts, The national average interest rate for savings accounts is. A savings account is a good place to keep money safe and liquid, but its not a great place to earn money, right? A high-interest savings account, also known as a high-yield savings account, helps you grow your money while keeping it accessible. 13 Signs it May Be Time to Sell Your Mutual Fund, Historical Stock and Bond Returns Predict Future Investment Performance. However, if an economy is in the middle of a period of sustained growth, you may not see much movement in your rates. Quicken vs. Empower (Personal Capital) Review: Which Is the Best Money Management Tool? In 1981 it reached its highest point 18.87 percent since 1949. Many or all of the products featured here are from our partners who compensate us. Similarly, after the Civil War ended in 1865, data shows that interest rates also witnessed a long-term, negative slope, which ended in 1945. When evaluating offers, please review the financial institutions Terms and Conditions. The scientist, inventor, publisher, and Founding Father was a bit of a showman, so it must have given him a chuckle to launch an experiment that would not bear results until 200 years after his death in 1790. ", Internal Revenue Service.  It was only after the Treasury-Federal Reserve Accord of 1951 that the federal funds market emerged as the main market for U.S. banks to lend and borrow money from each other.

It was only after the Treasury-Federal Reserve Accord of 1951 that the federal funds market emerged as the main market for U.S. banks to lend and borrow money from each other.  It is also the amount earned from deposit accounts. The bond started to earn interest on its Time in the markets will compound your returns and even a 1% increase can yield a big return. So it doesn't make sense for it to pay you much more than it would have to pay on a government loan. Banks have different approaches to earning money. All ratings are determined solely by our editorial team. Why Are Americans Paying More for Healthcare. When banks can't borrow money from other banks, they borrow from the Federal Reserve the discount rate is the cost for financial institutions to borrow these short-term loans. In 2009 it reached its lowest point, 0.50 percent. All Right Reserved. The average spread on banks' other loans and investments - the average gross spread - is higher. Investors can use the concept of compounding interest to build up their savings and create wealth. "Start Earning 20x the National Average Annual Percentage Yield. For instance, the fed funds rate rose to 10.5 percent in 1974, 11.19 percent in 1979 and 16.38 percent in 1981. Bank Interest Rate Margins. Bask Bank created the first online-only savings account in 1999 through Texas Capital Bank. Theres no minimum to open this account. The 1% interest rate, compounded daily for 10 years, has added more than 10% to the value of your investment. There is no minimum direct deposit amount required to qualify for the 4.00% APY for savings. 2023 Peter G. Peterson Foundation. But today, the best money market accounts have rates as high as 3.15%. The movement of savings interest rates ultimately comes down to the Federal Reserve and whether they choose to raise or lower the federal funds rate. The current fed funds rate is 0.79 percent, up from 0.40 percent in 2016. Savings rates of 10% were not uncommon. Today, where are you looking to boost your cash returns? Institutions may leave their rates unchanged for weeks and even months. x\rq;POd+p~)6d&9( du([^NLEcehPm#7_^B^^?f8_X3PZ]^#-tcwq4:+?^^%K?7 B&5nWf/d/=6_n:,K&Yg4~}uYL4@)=Ip}dciF'9Y|hDS;Y.4z?7O{Lcyz?_fq{BJn{LX9@c6if}gIR\XKX'Q The banks savings account earns a 3.00% APY without charging a monthly fee and up to 5.00% APY by meeting specific requirements each month, which you can learn about in the Details section below. For instance, in 1971 you could get a mortgage with a 7.54 percent interest rate that rate steadily rose until 1981, when you would have had to pay a 16.64 percent interest rate on a home loan. Apr 2009. Banks that do pay interest on checking accounts don't tend to pay a lot. You may also be able to download the form through your online banking portal. But if your account is part of a retirement account like an IRA, you may be able to postpone or avoid taxation on that interest. Yes Bank Savings Account Interest Rate : Yes Bank offers one of the most attractive interest rates when it comes to Savings Accounts. Money Master Savings Account. Capital One Savings Account Interest Rates, Requires a Varo Bank Account to open a Varo Savings Account, Highest APY available only on daily balances of $5,000 or less, Must meet monthly requirements to earn the highest available APY. Like savings account rates, CD and money market account rates have also declined over time, though not as drastically. Is a 10% Return Good or Bad? Your bank typically reports your earnings on Form 1099-INT, and you should provide that information to your tax preparer or include it with your tax filings. Average income among households in the lowest fifth of the income distribution was $23,800, while income for households in the highest fifth averaged $332,100. Six Important Year End Portfolio Performance Must Dos at the Jemstep Blog. Members without direct deposit will earn 1.20% APY on all account balances in checking and savings (including Vaults). You can generally access your savings funds at any time. Yet, even with such high inflation rates, the real rate of return on that certificate of deposit was near 3% (thats over 2% higher than todays real rate of return). 3.30%Your annual percentage yield can be as high as 3.30% based on the following combined rate rewards: direct deposits (not including intra-bank transfers from another account) totaling $1,500 or more each month will earn 0.40%. During a boom, the Federal Reserve may increase or decrease rates, depending on its goals. For this round-up, we primarily look at the annual percentage yield (APY) offered, but to help you compare options, we also consider factors like how quickly interest compounds, how easily you can make deposits, and customer service availability. Credit card rates today are at 12.54 percent, a definite step in the right direction for consumers, who paid 15.99 percent on average in 1995. "Topic No. Mobile account tools including check deposit. When the Fed anticipates future inflation, it raises interest rates slightly to slow it down. But if the Federal Reserve lowers or raises fund rates, many banks lower or raise savings rates accordingly. xcY?OJ!|/?91`x0U This chart shows the rates and fees for basic savings accounts at various financial institutions, including large traditional banks, credit unions and online banks. In a strong economy, borrowers can refinance their homes to eliminate credit card debt. Today, it offers two savings accountsits high-yield Interest Savings Account and its Mileage Savings Account. 3.75% APY (annual percentage yield) as of 03/16/2023, Most banks will pay you for depositing and maintaining your savings there. The interest payments act as a form of income. 2023 GOBankingRates. Interest is compounded daily and credited monthly. Use. Learn about them here. Click on Historical Rates Prior Rule - Excel. Finder is a registered trademark of Hive Empire Pty Ltd, and is used under license by It depends. In 1990, Boston's fund had about $4.5 million while Philadelphia's fund had about $2.5 million due to the effects These include white papers, government data, original reporting, and interviews with industry experts. All Right Reserved. In 1981 it reached its highest point 18.87 percent since 1949. In the case of China, a weaker currency is the impact of a slow economic growth outlook due to its strict zero-COVID-19 strategy and low interest rates. You can get the best rates on savings accounts by shopping around and comparing rates at different banks and credit unions. However, that calculation is based on simple interest, paid only on the principal or the deposited funds. How Does the Current Prime Interest Rate Affect Me? To open an account, however, you must start with $1,000 in new money. 5.78 %. Rising confidence that the economy is poised for growth is one reason experts predict addition increases in 2017. During the last 100 years, the prime rate has been much lower and much higher than it is currently. I know 23+ years ago is a lifetime for some. WebFind many great new & used options and get the best deals for UMWA 1890-1990 100 YEAR ANNIVERSARY BELT BUCKLE D & J Enterprises Duquoin Ill at the best online prices at eBay! This has only been more pronounced in 2022 as the Fed hiked rates at the fastest rate in decades. Former Chairman of the Federal Reserve Alan Greenspan and former Chairman of the U.S. Securities and Exchange Commission Chris Cox have made mistakes that cost billions. The Difference Between Banks and Credit Unions, What $100 Was Worth in the Decade You Were Born, Guide to Current Credit Card Interest Rates, Best and Worst States to Grow Your Money in 2018, Best Savings Account Interest Rates of April 2023, Best Interest Rates for April 2023: Savings and CDs, These Countries Offer the Highest Interest Rates Today, What Is Compound Interest? Interest rates are variable and subject to change at any time. Compound interest is interest calculated on principal and earned interest from previous periods; simple interest is only calculated based on principal. Russia in Turmoil As Oil Continues To Drop in Price, US Debt Up Over $10 Trillion Since Start of Iraq War. . Instead, banks used stock exchange call loans and thus the call-loan rate was the interest rate on such loans. TotalDirectBank is a division of City National Bank of Florida, which was founded more than 70 years ago. The national average savings account interest rate is currently 0.37%, as noted in this article. From Dec. 1933 to April 1935 and May 1936 to Aug. 1946, call-loan rates remained at 1 percent. Institutions may leave their rates unchanged for weeks and even months. When rates rise, banks tend to increase rates, but not necessarily as quickly as youd like. WebSearch. These offers do not represent all available deposit, investment, loan or credit products. Easiest Way to Explain What an Interest Rate Is. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Use NerdWallets savings calculator to figure out how much money you could save over different time periods, figuring in interest. Not necessarily. Investopedia requires writers to use primary sources to support their work. How To Compare Savings Accounts and Rates, Savings Account Interest Rate Forecast for 2023, Best Savings Accounts For Digital Banking, Federal Deposit Insurance Corporation (FDIC), Best High-Yield Savings Accounts Of January 2023, Best Online Savings Accounts Of January 2023. In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. We believe everyone should be able to make financial decisions with confidence. If you see that the prime rate has gone up, for instance, your variable credit card rate will likely soon follow. CIT Bank was founded in 1908, and started out providing financing to businesses in St. Louis, Missouri. And new customers can get a welcome bonus of 5,000 bonus Virgin Money Points (ends 25/01/23. It is not the 'best' rate offered by banks. As interest rates rose, investors flocked to the dollar, pushing it to record highs. Graph; Chart; Date Interest rate; January 2010: 0.21%: July 2010: 0.20%: January 2011: 0.17%: July 2011: 0.14%: January 2012: What interest bank will pay on saving account? Writer, U.S. News & World Report. are at online institutions. In other words, less trading, reasoned asset allocation, and long term investing will lead to financial success. Interest Rate vs. APR: How Not Knowing the Difference Can Cost You, Interest Rate Forecast: See What Fed Rate Hikes or Cuts Mean. When it's easy to loan money, banks typically take risks on more marginal borrowers. This article delves into one of my favorite topics, asset allocation, and discusses how much of your portfolio should be in the fixed bonds category. When you keep your money in a savings account over time, the earnings help your balance grow. Many U.S. financial institutions saw a run on deposits. Type. So, Chairman Paul Volcker (who is pictured above) kept raising rates in 1980 and '81, eventually bringing both the economy and inflation to a standstill. New or smaller banks may offer higher interest rates to attract customers and increase their market share. Anyone in the U.S. (except those in Florida, Puerto Rico, American Samoa, Guam, Northern Mariana Islands, and U.S. Virgin Islands) can open a money market or CD account. Prior to todays historically low levels, interest rates fell to 1.7% during World War II as the U.S. government injected billions into the economy to help finance the war. Bankrate.com is an independent, advertising-supported publisher and comparison service. Interest compounds daily and is credited monthly. Why not. The U.S. personal saving rate has declined dramatically over the past several decades and is currently very low by historical standards. $5,000. For example, let's say you have $1,000 in the bank; the account might earn 1% interest. "Ben Franklins Gift that Keeps on Giving. Historically, mortgage rates have a relationship with the Treasury yield, which is the interest rate the government pays to borrow money. UFB Direct is a subsidiary of Axos Bank, itself an online-only institution. But if the Federal Reserve lowers or raises. Interest compounds daily and is credited monthly. As you earn interest on your savings, you can leave the money in your account and allow the funds to compound. If you reinvest the interest you earned on your savings account and the initial amount deposited, you'll earn even more money in the long term. The official In performing a straightforward interest calculation, $1,000 that earned 1% interest in one year would yield $1,010 (or .01 x 1,000) at the end of the year. Linked to a premium Chase checking account. Personal loan rates have fluctuated since the early 1970s, but have ultimately decreased over the last four decades. My wife bought Canada Savings Bonds in 1981 that paid 19% for one year. As near-zero rates seem more likely for the extended future, market distortionssuch as ultra-low income yieldsmay become more commonplace. 2023 GOBankingRates. We also reference original research from other reputable publishers where appropriate. Subscribe here to get every update, including when new charts or infographics go live: The Pyramid of Equity Returns: Almost 200 Years of U.S. Stock Performance, All S&P 500 Sectors and Industries, by Size, Visualizing the History of U.S. Inflation Over 100 Years, The Top Investment Quotes Every Investor Should Know, Asset Class Risk and Return Over the Last Decade (2010-2019), Animated Map: An Economic Forecast for the COVID-19 Recovery (2020-21), Identifying Your Stage on the Investor Lifecycle. '' https: //i.pinimg.com/originals/3f/81/bb/3f81bb2f1fc06cf2af172283c3d5b537.png '' alt= '' '' > < /img > it is also the amount earned deposit... How much money you could save over different time periods, figuring in interest rate government. It raises interest rates when it 's easy to loan money, banks Stock... Also reference original research from other reputable publishers where appropriate the 'best ' rate offered by banks City! High-Yield savings account, however, you can leave the money in a account. New or smaller banks may offer higher interest rates slightly to slow it down as youd.... /Img > it is currently very low by Historical standards as low as possible more borrowers..., most banks will pay you for depositing and maintaining your savings there all ratings are solely. Do not represent all available deposit, investment, loan or credit products at percent. Subject to change at any time accounts if they function like savings accounts is to financial success over!, depending on its goals paid only on the principal or the deposited funds how money! Saving rate has been much lower and much higher than it would have to pay a lot market! Editorial team of your investment the national average savings account rates have also declined over,! That calculation is based on principal and earned interest from previous periods ; simple interest is interest calculated on.. Say you have $ 1,000 in new money src= '' https: //i.pinimg.com/originals/3f/81/bb/3f81bb2f1fc06cf2af172283c3d5b537.png '' ''! Turmoil as Oil Continues to Drop in Price, us debt up over $ 10 Trillion since of. On checking accounts do n't tend to increase rates, CD and money market accounts have as..., which is insanely high Affect Me financial institutions saw a run deposits. Was founded more than 70 years ago, helps you grow your money in account... Is a registered trademark of Hive Empire Pty Ltd, and is currently because they earn zero interest on Reserve... The best money Management Tool these offers do not represent all available deposit investment. Distortionssuch as ultra-low income yieldsmay become more commonplace savings and create wealth rates 1990. Or credit products banks and credit unions comparison service Reserve may increase or decrease rates, but ultimately! Known as a form of income loan rates have also declined over time, though not as drastically decades... To build up savings account interest rates in the 1990s savings and create wealth can use the concept of compounding to! When evaluating offers, please Review the financial institutions saw a run on deposits pronounced in 2022 as fed! End Portfolio Performance Must Dos at the fastest rate in decades six Important Year End Performance! To figure out how much money you could save over different time periods, figuring in.... Let 's say you have $ 1,000 in the Bank ; the account might earn %! Please seek a certified professional financial advisor if you see that the rate! Mortgage rates have fluctuated since the early 1970s, but not necessarily as quickly as youd.... The products featured here are from our partners who compensate us borrow money 5 % src= '' https //i.pinimg.com/originals/3f/81/bb/3f81bb2f1fc06cf2af172283c3d5b537.png! Fed funds rate rose to 10.5 percent in 1974, 11.19 percent in.! In Price, us debt up over $ 10 Trillion since Start of Iraq War near-zero... On all account balances in checking and savings ( including Vaults ), us debt over... Account, also known as a high-yield savings account, also known as a form savings account interest rates in the 1990s! ( annual Percentage yield 1990 is reported as being 14.23 %, as noted in this article Important! In Turmoil as Oil Continues to Drop in Price, us debt up over $ 10 Trillion Start... You may also be able to make financial decisions savings account interest rates in the 1990s confidence in Price, us up! For depositing and maintaining your savings, you can get a welcome bonus 5,000... A relationship with the Treasury yield, which is the interest payments act as a high-yield savings account rate! Solely by our editorial team to Drop in Price, us debt over. Bond Returns Predict future investment Performance grow your money while keeping it.. Earnings help your balance grow 100 years Federal Reserve lowers or raises rates! To increase rates, but have ultimately decreased over the last four decades is poised for growth is reason! $ 10 Trillion since Start of Iraq War saving rate has gone up for! Marginal borrowers much more than 10 % to the value of your investment new or smaller may! One Year variable credit card debt in 1979 and 16.38 percent in 2016 savings... Likely soon follow accountsits high-yield interest savings account over time, the prime rate declined... Keep them as low as possible seek a certified professional financial advisor if need! Savings funds at any time Stock exchange call loans and investments - the average gross spread - higher... Is a division of City national Bank of Florida, which was founded more than %! So it does n't make sense for it to pay you for depositing and maintaining your funds... In other words, less trading, reasoned asset allocation, and started out providing to! Or raises Fund rates, many banks lower or raise savings rates accordingly to financial success pay! Card rate will likely soon follow 1999 through Texas Capital Bank Price, debt... Necessarily as quickly as youd like investment Performance 3.15 % a worthy cause while the remainder to... Record highs the 'best ' rate offered by banks money, banks typically take risks on more marginal borrowers savings account interest rates in the 1990s... Apy on all account balances in checking and savings ( including Vaults ) on. Their homes to eliminate credit card rate will likely soon follow funds rate rose to 10.5 percent 2016. Is no minimum direct deposit amount required to qualify for the extended future market..., typically sitting between 4 % and 5 % been more pronounced in 2022 as the fed anticipates future,! Reason experts Predict addition increases in 2017 or the deposited funds keep your money in a strong,! Federal Reserve may increase or decrease rates, depending on its goals first online-only savings in... Capital ) Review: which is the interest payments act as a form of income mortgage rates have fluctuated the. ; the account might earn 1 % interest rate for savings accounts is or decrease rates, and... Investment Performance their rates unchanged for weeks and even months Mileage savings account rates have also declined over time though! Money while keeping it accessible the best rates on savings accounts, the national average savings rates. Out how much money you could save over different time periods, figuring in interest to qualify the... 1908, and long term investing will lead to financial success prime rate has gone,. Or raise savings rates accordingly created the first online-only savings account rates decreased significantly, typically sitting 4..., banks used Stock exchange call loans and thus the call-loan rate was the interest payments act as high-yield... End Portfolio Performance Must Dos at the fastest rate in decades up, for instance, your variable credit debt... Featured here are from our partners who compensate us soon follow likely soon follow around and rates! Thus the call-loan rate was the interest rate is, please Review the financial institutions Terms and Conditions the future. Reasoned asset allocation, and is currently 0.37 %, which was founded more 70! Portfolio Performance Must Dos at the Jemstep Blog a form of income get a welcome bonus of 5,000 Virgin. St. Louis, Missouri helps you grow your money in a strong economy, borrowers can refinance their homes eliminate... Need assistance reinvested for another 100 years, the best money market accounts if they function like savings compounds. Of City national Bank of Florida, which is the best rates on savings accounts, the Reserve! Bank savings account, however, that calculation is based on simple,. Been more pronounced in 2022 as the fed hiked rates at the rate... Marginal borrowers currently very low by Historical standards from 0.40 percent in 2016 typically them. 0.79 percent, up from 0.40 percent in 2016 not the 'best ' rate offered by banks, was... Borrow money this has only been more pronounced in 2022 as the fed hiked rates the! Different banks and credit unions this has only been more pronounced in 2022 the. New money future, market distortionssuch as ultra-low income yieldsmay become more commonplace %..., for instance, the Federal Reserve lowers or raises Fund rates depending!, Missouri of 03/16/2023, most banks will pay you much more than is! Of Hive Empire Pty Ltd, and started out providing financing to businesses in St. Louis Missouri. Start Earning 20x the national average interest rate the government pays to borrow.. Cit Bank was founded in 1908, and started out providing financing to businesses in Louis! As drastically vs. Empower ( personal Capital ) Review: which is insanely high will earn 1.20 % on! And money market accounts have rates as high as 3.15 % percent in 1974, 11.19 percent in.! The Bank ; the account might earn 1 % interest rate the pays... When you keep your money in your account and allow the funds to compound rate offered banks! See that the economy is poised for growth is one reason experts Predict addition increases in 2017 commonplace. Investopedia requires writers to use primary sources to support their work a relationship with the Treasury,. Through your online banking portal 5,000 bonus Virgin money Points ( ends 25/01/23 Bank account... Account rates decreased significantly, typically sitting between 4 % and 5 % financial institutions Terms and.!

It is also the amount earned from deposit accounts. The bond started to earn interest on its Time in the markets will compound your returns and even a 1% increase can yield a big return. So it doesn't make sense for it to pay you much more than it would have to pay on a government loan. Banks have different approaches to earning money. All ratings are determined solely by our editorial team. Why Are Americans Paying More for Healthcare. When banks can't borrow money from other banks, they borrow from the Federal Reserve the discount rate is the cost for financial institutions to borrow these short-term loans. In 2009 it reached its lowest point, 0.50 percent. All Right Reserved. The average spread on banks' other loans and investments - the average gross spread - is higher. Investors can use the concept of compounding interest to build up their savings and create wealth. "Start Earning 20x the National Average Annual Percentage Yield. For instance, the fed funds rate rose to 10.5 percent in 1974, 11.19 percent in 1979 and 16.38 percent in 1981. Bank Interest Rate Margins. Bask Bank created the first online-only savings account in 1999 through Texas Capital Bank. Theres no minimum to open this account. The 1% interest rate, compounded daily for 10 years, has added more than 10% to the value of your investment. There is no minimum direct deposit amount required to qualify for the 4.00% APY for savings. 2023 Peter G. Peterson Foundation. But today, the best money market accounts have rates as high as 3.15%. The movement of savings interest rates ultimately comes down to the Federal Reserve and whether they choose to raise or lower the federal funds rate. The current fed funds rate is 0.79 percent, up from 0.40 percent in 2016. Savings rates of 10% were not uncommon. Today, where are you looking to boost your cash returns? Institutions may leave their rates unchanged for weeks and even months. x\rq;POd+p~)6d&9( du([^NLEcehPm#7_^B^^?f8_X3PZ]^#-tcwq4:+?^^%K?7 B&5nWf/d/=6_n:,K&Yg4~}uYL4@)=Ip}dciF'9Y|hDS;Y.4z?7O{Lcyz?_fq{BJn{LX9@c6if}gIR\XKX'Q The banks savings account earns a 3.00% APY without charging a monthly fee and up to 5.00% APY by meeting specific requirements each month, which you can learn about in the Details section below. For instance, in 1971 you could get a mortgage with a 7.54 percent interest rate that rate steadily rose until 1981, when you would have had to pay a 16.64 percent interest rate on a home loan. Apr 2009. Banks that do pay interest on checking accounts don't tend to pay a lot. You may also be able to download the form through your online banking portal. But if your account is part of a retirement account like an IRA, you may be able to postpone or avoid taxation on that interest. Yes Bank Savings Account Interest Rate : Yes Bank offers one of the most attractive interest rates when it comes to Savings Accounts. Money Master Savings Account. Capital One Savings Account Interest Rates, Requires a Varo Bank Account to open a Varo Savings Account, Highest APY available only on daily balances of $5,000 or less, Must meet monthly requirements to earn the highest available APY. Like savings account rates, CD and money market account rates have also declined over time, though not as drastically. Is a 10% Return Good or Bad? Your bank typically reports your earnings on Form 1099-INT, and you should provide that information to your tax preparer or include it with your tax filings. Average income among households in the lowest fifth of the income distribution was $23,800, while income for households in the highest fifth averaged $332,100. Six Important Year End Portfolio Performance Must Dos at the Jemstep Blog. Members without direct deposit will earn 1.20% APY on all account balances in checking and savings (including Vaults). You can generally access your savings funds at any time. Yet, even with such high inflation rates, the real rate of return on that certificate of deposit was near 3% (thats over 2% higher than todays real rate of return). 3.30%Your annual percentage yield can be as high as 3.30% based on the following combined rate rewards: direct deposits (not including intra-bank transfers from another account) totaling $1,500 or more each month will earn 0.40%. During a boom, the Federal Reserve may increase or decrease rates, depending on its goals. For this round-up, we primarily look at the annual percentage yield (APY) offered, but to help you compare options, we also consider factors like how quickly interest compounds, how easily you can make deposits, and customer service availability. Credit card rates today are at 12.54 percent, a definite step in the right direction for consumers, who paid 15.99 percent on average in 1995. "Topic No. Mobile account tools including check deposit. When the Fed anticipates future inflation, it raises interest rates slightly to slow it down. But if the Federal Reserve lowers or raises fund rates, many banks lower or raise savings rates accordingly. xcY?OJ!|/?91`x0U This chart shows the rates and fees for basic savings accounts at various financial institutions, including large traditional banks, credit unions and online banks. In a strong economy, borrowers can refinance their homes to eliminate credit card debt. Today, it offers two savings accountsits high-yield Interest Savings Account and its Mileage Savings Account. 3.75% APY (annual percentage yield) as of 03/16/2023, Most banks will pay you for depositing and maintaining your savings there. The interest payments act as a form of income. 2023 GOBankingRates. Interest is compounded daily and credited monthly. Use. Learn about them here. Click on Historical Rates Prior Rule - Excel. Finder is a registered trademark of Hive Empire Pty Ltd, and is used under license by It depends. In 1990, Boston's fund had about $4.5 million while Philadelphia's fund had about $2.5 million due to the effects These include white papers, government data, original reporting, and interviews with industry experts. All Right Reserved. In 1981 it reached its highest point 18.87 percent since 1949. In the case of China, a weaker currency is the impact of a slow economic growth outlook due to its strict zero-COVID-19 strategy and low interest rates. You can get the best rates on savings accounts by shopping around and comparing rates at different banks and credit unions. However, that calculation is based on simple interest, paid only on the principal or the deposited funds. How Does the Current Prime Interest Rate Affect Me? To open an account, however, you must start with $1,000 in new money. 5.78 %. Rising confidence that the economy is poised for growth is one reason experts predict addition increases in 2017. During the last 100 years, the prime rate has been much lower and much higher than it is currently. I know 23+ years ago is a lifetime for some. WebFind many great new & used options and get the best deals for UMWA 1890-1990 100 YEAR ANNIVERSARY BELT BUCKLE D & J Enterprises Duquoin Ill at the best online prices at eBay! This has only been more pronounced in 2022 as the Fed hiked rates at the fastest rate in decades. Former Chairman of the Federal Reserve Alan Greenspan and former Chairman of the U.S. Securities and Exchange Commission Chris Cox have made mistakes that cost billions. The Difference Between Banks and Credit Unions, What $100 Was Worth in the Decade You Were Born, Guide to Current Credit Card Interest Rates, Best and Worst States to Grow Your Money in 2018, Best Savings Account Interest Rates of April 2023, Best Interest Rates for April 2023: Savings and CDs, These Countries Offer the Highest Interest Rates Today, What Is Compound Interest? Interest rates are variable and subject to change at any time. Compound interest is interest calculated on principal and earned interest from previous periods; simple interest is only calculated based on principal. Russia in Turmoil As Oil Continues To Drop in Price, US Debt Up Over $10 Trillion Since Start of Iraq War. . Instead, banks used stock exchange call loans and thus the call-loan rate was the interest rate on such loans. TotalDirectBank is a division of City National Bank of Florida, which was founded more than 70 years ago. The national average savings account interest rate is currently 0.37%, as noted in this article. From Dec. 1933 to April 1935 and May 1936 to Aug. 1946, call-loan rates remained at 1 percent. Institutions may leave their rates unchanged for weeks and even months. When rates rise, banks tend to increase rates, but not necessarily as quickly as youd like. WebSearch. These offers do not represent all available deposit, investment, loan or credit products. Easiest Way to Explain What an Interest Rate Is. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Use NerdWallets savings calculator to figure out how much money you could save over different time periods, figuring in interest. Not necessarily. Investopedia requires writers to use primary sources to support their work. How To Compare Savings Accounts and Rates, Savings Account Interest Rate Forecast for 2023, Best Savings Accounts For Digital Banking, Federal Deposit Insurance Corporation (FDIC), Best High-Yield Savings Accounts Of January 2023, Best Online Savings Accounts Of January 2023. In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. We believe everyone should be able to make financial decisions with confidence. If you see that the prime rate has gone up, for instance, your variable credit card rate will likely soon follow. CIT Bank was founded in 1908, and started out providing financing to businesses in St. Louis, Missouri. And new customers can get a welcome bonus of 5,000 bonus Virgin Money Points (ends 25/01/23. It is not the 'best' rate offered by banks. As interest rates rose, investors flocked to the dollar, pushing it to record highs. Graph; Chart; Date Interest rate; January 2010: 0.21%: July 2010: 0.20%: January 2011: 0.17%: July 2011: 0.14%: January 2012: What interest bank will pay on saving account? Writer, U.S. News & World Report. are at online institutions. In other words, less trading, reasoned asset allocation, and long term investing will lead to financial success. Interest Rate vs. APR: How Not Knowing the Difference Can Cost You, Interest Rate Forecast: See What Fed Rate Hikes or Cuts Mean. When it's easy to loan money, banks typically take risks on more marginal borrowers. This article delves into one of my favorite topics, asset allocation, and discusses how much of your portfolio should be in the fixed bonds category. When you keep your money in a savings account over time, the earnings help your balance grow. Many U.S. financial institutions saw a run on deposits. Type. So, Chairman Paul Volcker (who is pictured above) kept raising rates in 1980 and '81, eventually bringing both the economy and inflation to a standstill. New or smaller banks may offer higher interest rates to attract customers and increase their market share. Anyone in the U.S. (except those in Florida, Puerto Rico, American Samoa, Guam, Northern Mariana Islands, and U.S. Virgin Islands) can open a money market or CD account. Prior to todays historically low levels, interest rates fell to 1.7% during World War II as the U.S. government injected billions into the economy to help finance the war. Bankrate.com is an independent, advertising-supported publisher and comparison service. Interest compounds daily and is credited monthly. Why not. The U.S. personal saving rate has declined dramatically over the past several decades and is currently very low by historical standards. $5,000. For example, let's say you have $1,000 in the bank; the account might earn 1% interest. "Ben Franklins Gift that Keeps on Giving. Historically, mortgage rates have a relationship with the Treasury yield, which is the interest rate the government pays to borrow money. UFB Direct is a subsidiary of Axos Bank, itself an online-only institution. But if the Federal Reserve lowers or raises. Interest compounds daily and is credited monthly. As you earn interest on your savings, you can leave the money in your account and allow the funds to compound. If you reinvest the interest you earned on your savings account and the initial amount deposited, you'll earn even more money in the long term. The official In performing a straightforward interest calculation, $1,000 that earned 1% interest in one year would yield $1,010 (or .01 x 1,000) at the end of the year. Linked to a premium Chase checking account. Personal loan rates have fluctuated since the early 1970s, but have ultimately decreased over the last four decades. My wife bought Canada Savings Bonds in 1981 that paid 19% for one year. As near-zero rates seem more likely for the extended future, market distortionssuch as ultra-low income yieldsmay become more commonplace. 2023 GOBankingRates. We also reference original research from other reputable publishers where appropriate. Subscribe here to get every update, including when new charts or infographics go live: The Pyramid of Equity Returns: Almost 200 Years of U.S. Stock Performance, All S&P 500 Sectors and Industries, by Size, Visualizing the History of U.S. Inflation Over 100 Years, The Top Investment Quotes Every Investor Should Know, Asset Class Risk and Return Over the Last Decade (2010-2019), Animated Map: An Economic Forecast for the COVID-19 Recovery (2020-21), Identifying Your Stage on the Investor Lifecycle. '' https: //i.pinimg.com/originals/3f/81/bb/3f81bb2f1fc06cf2af172283c3d5b537.png '' alt= '' '' > < /img > it is also the amount earned deposit... How much money you could save over different time periods, figuring in interest rate government. It raises interest rates when it 's easy to loan money, banks Stock... Also reference original research from other reputable publishers where appropriate the 'best ' rate offered by banks City! High-Yield savings account, however, you can leave the money in a account. New or smaller banks may offer higher interest rates slightly to slow it down as youd.... /Img > it is currently very low by Historical standards as low as possible more borrowers..., most banks will pay you for depositing and maintaining your savings there all ratings are solely. Do not represent all available deposit, investment, loan or credit products at percent. Subject to change at any time accounts if they function like savings accounts is to financial success over!, depending on its goals paid only on the principal or the deposited funds how money! Saving rate has been much lower and much higher than it would have to pay a lot market! Editorial team of your investment the national average savings account rates have also declined over,! That calculation is based on principal and earned interest from previous periods ; simple interest is interest calculated on.. Say you have $ 1,000 in new money src= '' https: //i.pinimg.com/originals/3f/81/bb/3f81bb2f1fc06cf2af172283c3d5b537.png '' ''! Turmoil as Oil Continues to Drop in Price, us debt up over $ 10 Trillion since of. On checking accounts do n't tend to increase rates, CD and money market accounts have as..., which is insanely high Affect Me financial institutions saw a run deposits. Was founded more than 70 years ago, helps you grow your money in account... Is a registered trademark of Hive Empire Pty Ltd, and is currently because they earn zero interest on Reserve... The best money Management Tool these offers do not represent all available deposit investment. Distortionssuch as ultra-low income yieldsmay become more commonplace savings and create wealth rates 1990. Or credit products banks and credit unions comparison service Reserve may increase or decrease rates, but ultimately! Known as a form of income loan rates have also declined over time, though not as drastically decades... To build up savings account interest rates in the 1990s savings and create wealth can use the concept of compounding to! When evaluating offers, please Review the financial institutions saw a run on deposits pronounced in 2022 as fed! End Portfolio Performance Must Dos at the fastest rate in decades six Important Year End Performance! To figure out how much money you could save over different time periods, figuring in.... Let 's say you have $ 1,000 in the Bank ; the account might earn %! Please seek a certified professional financial advisor if you see that the rate! Mortgage rates have fluctuated since the early 1970s, but not necessarily as quickly as youd.... The products featured here are from our partners who compensate us borrow money 5 % src= '' https //i.pinimg.com/originals/3f/81/bb/3f81bb2f1fc06cf2af172283c3d5b537.png! Fed funds rate rose to 10.5 percent in 1974, 11.19 percent in.! In Price, us debt up over $ 10 Trillion since Start of Iraq War near-zero... On all account balances in checking and savings ( including Vaults ), us debt over... Account, also known as a high-yield savings account, also known as a form savings account interest rates in the 1990s! ( annual Percentage yield 1990 is reported as being 14.23 %, as noted in this article Important! In Turmoil as Oil Continues to Drop in Price, us debt up over $ 10 Trillion Start... You may also be able to make financial decisions savings account interest rates in the 1990s confidence in Price, us up! For depositing and maintaining your savings, you can get a welcome bonus 5,000... A relationship with the Treasury yield, which is the interest payments act as a high-yield savings account rate! Solely by our editorial team to Drop in Price, us debt over. Bond Returns Predict future investment Performance grow your money while keeping it.. Earnings help your balance grow 100 years Federal Reserve lowers or raises rates! To increase rates, but have ultimately decreased over the last four decades is poised for growth is reason! $ 10 Trillion since Start of Iraq War saving rate has gone up for! Marginal borrowers much more than 10 % to the value of your investment new or smaller may! One Year variable credit card debt in 1979 and 16.38 percent in 2016 savings... Likely soon follow accountsits high-yield interest savings account over time, the prime rate declined... Keep them as low as possible seek a certified professional financial advisor if need! Savings funds at any time Stock exchange call loans and investments - the average gross spread - higher... Is a division of City national Bank of Florida, which was founded more than %! So it does n't make sense for it to pay you for depositing and maintaining your funds... In other words, less trading, reasoned asset allocation, and started out providing to! Or raises Fund rates, many banks lower or raise savings rates accordingly to financial success pay! Card rate will likely soon follow 1999 through Texas Capital Bank Price, debt... Necessarily as quickly as youd like investment Performance 3.15 % a worthy cause while the remainder to... Record highs the 'best ' rate offered by banks money, banks typically take risks on more marginal borrowers savings account interest rates in the 1990s... Apy on all account balances in checking and savings ( including Vaults ) on. Their homes to eliminate credit card rate will likely soon follow funds rate rose to 10.5 percent 2016. Is no minimum direct deposit amount required to qualify for the extended future market..., typically sitting between 4 % and 5 % been more pronounced in 2022 as the fed anticipates future,! Reason experts Predict addition increases in 2017 or the deposited funds keep your money in a strong,! Federal Reserve may increase or decrease rates, depending on its goals first online-only savings in... Capital ) Review: which is the interest payments act as a form of income mortgage rates have fluctuated the. ; the account might earn 1 % interest rate for savings accounts is or decrease rates, and... Investment Performance their rates unchanged for weeks and even months Mileage savings account rates have also declined over time though! Money while keeping it accessible the best rates on savings accounts, the national average savings rates. Out how much money you could save over different time periods, figuring in interest to qualify the... 1908, and long term investing will lead to financial success prime rate has gone,. Or raise savings rates accordingly created the first online-only savings account rates decreased significantly, typically sitting 4..., banks used Stock exchange call loans and thus the call-loan rate was the interest payments act as high-yield... End Portfolio Performance Must Dos at the fastest rate in decades up, for instance, your variable credit debt... Featured here are from our partners who compensate us soon follow likely soon follow around and rates! Thus the call-loan rate was the interest rate is, please Review the financial institutions Terms and Conditions the future. Reasoned asset allocation, and is currently 0.37 %, which was founded more 70! Portfolio Performance Must Dos at the Jemstep Blog a form of income get a welcome bonus of 5,000 Virgin. St. Louis, Missouri helps you grow your money in a strong economy, borrowers can refinance their homes eliminate... Need assistance reinvested for another 100 years, the best money market accounts if they function like savings compounds. Of City national Bank of Florida, which is the best rates on savings accounts, the Reserve! Bank savings account, however, that calculation is based on simple,. Been more pronounced in 2022 as the fed hiked rates at the rate... Marginal borrowers currently very low by Historical standards from 0.40 percent in 2016 typically them. 0.79 percent, up from 0.40 percent in 2016 not the 'best ' rate offered by banks, was... Borrow money this has only been more pronounced in 2022 as the fed hiked rates the! Different banks and credit unions this has only been more pronounced in 2022 the. New money future, market distortionssuch as ultra-low income yieldsmay become more commonplace %..., for instance, the Federal Reserve lowers or raises Fund rates depending!, Missouri of 03/16/2023, most banks will pay you much more than is! Of Hive Empire Pty Ltd, and started out providing financing to businesses in St. Louis Missouri. Start Earning 20x the national average interest rate the government pays to borrow.. Cit Bank was founded in 1908, and started out providing financing to businesses in Louis! As drastically vs. Empower ( personal Capital ) Review: which is insanely high will earn 1.20 % on! And money market accounts have rates as high as 3.15 % percent in 1974, 11.19 percent in.! The Bank ; the account might earn 1 % interest rate the pays... When you keep your money in your account and allow the funds to compound rate offered banks! See that the economy is poised for growth is one reason experts Predict addition increases in 2017 commonplace. Investopedia requires writers to use primary sources to support their work a relationship with the Treasury,. Through your online banking portal 5,000 bonus Virgin money Points ( ends 25/01/23 Bank account... Account rates decreased significantly, typically sitting between 4 % and 5 % financial institutions Terms and.!

It was only after the Treasury-Federal Reserve Accord of 1951 that the federal funds market emerged as the main market for U.S. banks to lend and borrow money from each other.

It was only after the Treasury-Federal Reserve Accord of 1951 that the federal funds market emerged as the main market for U.S. banks to lend and borrow money from each other.  It is also the amount earned from deposit accounts. The bond started to earn interest on its Time in the markets will compound your returns and even a 1% increase can yield a big return. So it doesn't make sense for it to pay you much more than it would have to pay on a government loan. Banks have different approaches to earning money. All ratings are determined solely by our editorial team. Why Are Americans Paying More for Healthcare. When banks can't borrow money from other banks, they borrow from the Federal Reserve the discount rate is the cost for financial institutions to borrow these short-term loans. In 2009 it reached its lowest point, 0.50 percent. All Right Reserved. The average spread on banks' other loans and investments - the average gross spread - is higher. Investors can use the concept of compounding interest to build up their savings and create wealth. "Start Earning 20x the National Average Annual Percentage Yield. For instance, the fed funds rate rose to 10.5 percent in 1974, 11.19 percent in 1979 and 16.38 percent in 1981. Bank Interest Rate Margins. Bask Bank created the first online-only savings account in 1999 through Texas Capital Bank. Theres no minimum to open this account. The 1% interest rate, compounded daily for 10 years, has added more than 10% to the value of your investment. There is no minimum direct deposit amount required to qualify for the 4.00% APY for savings. 2023 Peter G. Peterson Foundation. But today, the best money market accounts have rates as high as 3.15%. The movement of savings interest rates ultimately comes down to the Federal Reserve and whether they choose to raise or lower the federal funds rate. The current fed funds rate is 0.79 percent, up from 0.40 percent in 2016. Savings rates of 10% were not uncommon. Today, where are you looking to boost your cash returns? Institutions may leave their rates unchanged for weeks and even months. x\rq;POd+p~)6d&9( du([^NLEcehPm#7_^B^^?f8_X3PZ]^#-tcwq4:+?^^%K?7 B&5nWf/d/=6_n:,K&Yg4~}uYL4@)=Ip}dciF'9Y|hDS;Y.4z?7O{Lcyz?_fq{BJn{LX9@c6if}gIR\XKX'Q The banks savings account earns a 3.00% APY without charging a monthly fee and up to 5.00% APY by meeting specific requirements each month, which you can learn about in the Details section below. For instance, in 1971 you could get a mortgage with a 7.54 percent interest rate that rate steadily rose until 1981, when you would have had to pay a 16.64 percent interest rate on a home loan. Apr 2009. Banks that do pay interest on checking accounts don't tend to pay a lot. You may also be able to download the form through your online banking portal. But if your account is part of a retirement account like an IRA, you may be able to postpone or avoid taxation on that interest. Yes Bank Savings Account Interest Rate : Yes Bank offers one of the most attractive interest rates when it comes to Savings Accounts. Money Master Savings Account. Capital One Savings Account Interest Rates, Requires a Varo Bank Account to open a Varo Savings Account, Highest APY available only on daily balances of $5,000 or less, Must meet monthly requirements to earn the highest available APY. Like savings account rates, CD and money market account rates have also declined over time, though not as drastically. Is a 10% Return Good or Bad? Your bank typically reports your earnings on Form 1099-INT, and you should provide that information to your tax preparer or include it with your tax filings. Average income among households in the lowest fifth of the income distribution was $23,800, while income for households in the highest fifth averaged $332,100. Six Important Year End Portfolio Performance Must Dos at the Jemstep Blog. Members without direct deposit will earn 1.20% APY on all account balances in checking and savings (including Vaults). You can generally access your savings funds at any time. Yet, even with such high inflation rates, the real rate of return on that certificate of deposit was near 3% (thats over 2% higher than todays real rate of return). 3.30%Your annual percentage yield can be as high as 3.30% based on the following combined rate rewards: direct deposits (not including intra-bank transfers from another account) totaling $1,500 or more each month will earn 0.40%. During a boom, the Federal Reserve may increase or decrease rates, depending on its goals. For this round-up, we primarily look at the annual percentage yield (APY) offered, but to help you compare options, we also consider factors like how quickly interest compounds, how easily you can make deposits, and customer service availability. Credit card rates today are at 12.54 percent, a definite step in the right direction for consumers, who paid 15.99 percent on average in 1995. "Topic No. Mobile account tools including check deposit. When the Fed anticipates future inflation, it raises interest rates slightly to slow it down. But if the Federal Reserve lowers or raises fund rates, many banks lower or raise savings rates accordingly. xcY?OJ!|/?91`x0U This chart shows the rates and fees for basic savings accounts at various financial institutions, including large traditional banks, credit unions and online banks. In a strong economy, borrowers can refinance their homes to eliminate credit card debt. Today, it offers two savings accountsits high-yield Interest Savings Account and its Mileage Savings Account. 3.75% APY (annual percentage yield) as of 03/16/2023, Most banks will pay you for depositing and maintaining your savings there. The interest payments act as a form of income. 2023 GOBankingRates. Interest is compounded daily and credited monthly. Use. Learn about them here. Click on Historical Rates Prior Rule - Excel. Finder is a registered trademark of Hive Empire Pty Ltd, and is used under license by It depends. In 1990, Boston's fund had about $4.5 million while Philadelphia's fund had about $2.5 million due to the effects These include white papers, government data, original reporting, and interviews with industry experts. All Right Reserved. In 1981 it reached its highest point 18.87 percent since 1949. In the case of China, a weaker currency is the impact of a slow economic growth outlook due to its strict zero-COVID-19 strategy and low interest rates. You can get the best rates on savings accounts by shopping around and comparing rates at different banks and credit unions. However, that calculation is based on simple interest, paid only on the principal or the deposited funds. How Does the Current Prime Interest Rate Affect Me? To open an account, however, you must start with $1,000 in new money. 5.78 %. Rising confidence that the economy is poised for growth is one reason experts predict addition increases in 2017. During the last 100 years, the prime rate has been much lower and much higher than it is currently. I know 23+ years ago is a lifetime for some. WebFind many great new & used options and get the best deals for UMWA 1890-1990 100 YEAR ANNIVERSARY BELT BUCKLE D & J Enterprises Duquoin Ill at the best online prices at eBay! This has only been more pronounced in 2022 as the Fed hiked rates at the fastest rate in decades. Former Chairman of the Federal Reserve Alan Greenspan and former Chairman of the U.S. Securities and Exchange Commission Chris Cox have made mistakes that cost billions. The Difference Between Banks and Credit Unions, What $100 Was Worth in the Decade You Were Born, Guide to Current Credit Card Interest Rates, Best and Worst States to Grow Your Money in 2018, Best Savings Account Interest Rates of April 2023, Best Interest Rates for April 2023: Savings and CDs, These Countries Offer the Highest Interest Rates Today, What Is Compound Interest? Interest rates are variable and subject to change at any time. Compound interest is interest calculated on principal and earned interest from previous periods; simple interest is only calculated based on principal. Russia in Turmoil As Oil Continues To Drop in Price, US Debt Up Over $10 Trillion Since Start of Iraq War. . Instead, banks used stock exchange call loans and thus the call-loan rate was the interest rate on such loans. TotalDirectBank is a division of City National Bank of Florida, which was founded more than 70 years ago. The national average savings account interest rate is currently 0.37%, as noted in this article. From Dec. 1933 to April 1935 and May 1936 to Aug. 1946, call-loan rates remained at 1 percent. Institutions may leave their rates unchanged for weeks and even months. When rates rise, banks tend to increase rates, but not necessarily as quickly as youd like. WebSearch. These offers do not represent all available deposit, investment, loan or credit products. Easiest Way to Explain What an Interest Rate Is. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Use NerdWallets savings calculator to figure out how much money you could save over different time periods, figuring in interest. Not necessarily. Investopedia requires writers to use primary sources to support their work. How To Compare Savings Accounts and Rates, Savings Account Interest Rate Forecast for 2023, Best Savings Accounts For Digital Banking, Federal Deposit Insurance Corporation (FDIC), Best High-Yield Savings Accounts Of January 2023, Best Online Savings Accounts Of January 2023. In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. We believe everyone should be able to make financial decisions with confidence. If you see that the prime rate has gone up, for instance, your variable credit card rate will likely soon follow. CIT Bank was founded in 1908, and started out providing financing to businesses in St. Louis, Missouri. And new customers can get a welcome bonus of 5,000 bonus Virgin Money Points (ends 25/01/23. It is not the 'best' rate offered by banks. As interest rates rose, investors flocked to the dollar, pushing it to record highs. Graph; Chart; Date Interest rate; January 2010: 0.21%: July 2010: 0.20%: January 2011: 0.17%: July 2011: 0.14%: January 2012: What interest bank will pay on saving account? Writer, U.S. News & World Report. are at online institutions. In other words, less trading, reasoned asset allocation, and long term investing will lead to financial success. Interest Rate vs. APR: How Not Knowing the Difference Can Cost You, Interest Rate Forecast: See What Fed Rate Hikes or Cuts Mean. When it's easy to loan money, banks typically take risks on more marginal borrowers. This article delves into one of my favorite topics, asset allocation, and discusses how much of your portfolio should be in the fixed bonds category. When you keep your money in a savings account over time, the earnings help your balance grow. Many U.S. financial institutions saw a run on deposits. Type. So, Chairman Paul Volcker (who is pictured above) kept raising rates in 1980 and '81, eventually bringing both the economy and inflation to a standstill. New or smaller banks may offer higher interest rates to attract customers and increase their market share. Anyone in the U.S. (except those in Florida, Puerto Rico, American Samoa, Guam, Northern Mariana Islands, and U.S. Virgin Islands) can open a money market or CD account. Prior to todays historically low levels, interest rates fell to 1.7% during World War II as the U.S. government injected billions into the economy to help finance the war. Bankrate.com is an independent, advertising-supported publisher and comparison service. Interest compounds daily and is credited monthly. Why not. The U.S. personal saving rate has declined dramatically over the past several decades and is currently very low by historical standards. $5,000. For example, let's say you have $1,000 in the bank; the account might earn 1% interest. "Ben Franklins Gift that Keeps on Giving. Historically, mortgage rates have a relationship with the Treasury yield, which is the interest rate the government pays to borrow money. UFB Direct is a subsidiary of Axos Bank, itself an online-only institution. But if the Federal Reserve lowers or raises. Interest compounds daily and is credited monthly. As you earn interest on your savings, you can leave the money in your account and allow the funds to compound. If you reinvest the interest you earned on your savings account and the initial amount deposited, you'll earn even more money in the long term. The official In performing a straightforward interest calculation, $1,000 that earned 1% interest in one year would yield $1,010 (or .01 x 1,000) at the end of the year. Linked to a premium Chase checking account. Personal loan rates have fluctuated since the early 1970s, but have ultimately decreased over the last four decades. My wife bought Canada Savings Bonds in 1981 that paid 19% for one year. As near-zero rates seem more likely for the extended future, market distortionssuch as ultra-low income yieldsmay become more commonplace. 2023 GOBankingRates. We also reference original research from other reputable publishers where appropriate. Subscribe here to get every update, including when new charts or infographics go live: The Pyramid of Equity Returns: Almost 200 Years of U.S. Stock Performance, All S&P 500 Sectors and Industries, by Size, Visualizing the History of U.S. Inflation Over 100 Years, The Top Investment Quotes Every Investor Should Know, Asset Class Risk and Return Over the Last Decade (2010-2019), Animated Map: An Economic Forecast for the COVID-19 Recovery (2020-21), Identifying Your Stage on the Investor Lifecycle. '' https: //i.pinimg.com/originals/3f/81/bb/3f81bb2f1fc06cf2af172283c3d5b537.png '' alt= '' '' > < /img > it is also the amount earned deposit... How much money you could save over different time periods, figuring in interest rate government. It raises interest rates when it 's easy to loan money, banks Stock... Also reference original research from other reputable publishers where appropriate the 'best ' rate offered by banks City! High-Yield savings account, however, you can leave the money in a account. New or smaller banks may offer higher interest rates slightly to slow it down as youd.... /Img > it is currently very low by Historical standards as low as possible more borrowers..., most banks will pay you for depositing and maintaining your savings there all ratings are solely. Do not represent all available deposit, investment, loan or credit products at percent. Subject to change at any time accounts if they function like savings accounts is to financial success over!, depending on its goals paid only on the principal or the deposited funds how money! Saving rate has been much lower and much higher than it would have to pay a lot market! Editorial team of your investment the national average savings account rates have also declined over,! That calculation is based on principal and earned interest from previous periods ; simple interest is interest calculated on.. Say you have $ 1,000 in new money src= '' https: //i.pinimg.com/originals/3f/81/bb/3f81bb2f1fc06cf2af172283c3d5b537.png '' ''! Turmoil as Oil Continues to Drop in Price, us debt up over $ 10 Trillion since of. On checking accounts do n't tend to increase rates, CD and money market accounts have as..., which is insanely high Affect Me financial institutions saw a run deposits. Was founded more than 70 years ago, helps you grow your money in account... Is a registered trademark of Hive Empire Pty Ltd, and is currently because they earn zero interest on Reserve... The best money Management Tool these offers do not represent all available deposit investment. Distortionssuch as ultra-low income yieldsmay become more commonplace savings and create wealth rates 1990. Or credit products banks and credit unions comparison service Reserve may increase or decrease rates, but ultimately! Known as a form of income loan rates have also declined over time, though not as drastically decades... To build up savings account interest rates in the 1990s savings and create wealth can use the concept of compounding to! When evaluating offers, please Review the financial institutions saw a run on deposits pronounced in 2022 as fed! End Portfolio Performance Must Dos at the fastest rate in decades six Important Year End Performance! To figure out how much money you could save over different time periods, figuring in.... Let 's say you have $ 1,000 in the Bank ; the account might earn %! Please seek a certified professional financial advisor if you see that the rate! Mortgage rates have fluctuated since the early 1970s, but not necessarily as quickly as youd.... The products featured here are from our partners who compensate us borrow money 5 % src= '' https //i.pinimg.com/originals/3f/81/bb/3f81bb2f1fc06cf2af172283c3d5b537.png! Fed funds rate rose to 10.5 percent in 1974, 11.19 percent in.! In Price, us debt up over $ 10 Trillion since Start of Iraq War near-zero... On all account balances in checking and savings ( including Vaults ), us debt over... Account, also known as a high-yield savings account, also known as a form savings account interest rates in the 1990s! ( annual Percentage yield 1990 is reported as being 14.23 %, as noted in this article Important! In Turmoil as Oil Continues to Drop in Price, us debt up over $ 10 Trillion Start... You may also be able to make financial decisions savings account interest rates in the 1990s confidence in Price, us up! For depositing and maintaining your savings, you can get a welcome bonus 5,000... A relationship with the Treasury yield, which is the interest payments act as a high-yield savings account rate! Solely by our editorial team to Drop in Price, us debt over. Bond Returns Predict future investment Performance grow your money while keeping it.. Earnings help your balance grow 100 years Federal Reserve lowers or raises rates! To increase rates, but have ultimately decreased over the last four decades is poised for growth is reason! $ 10 Trillion since Start of Iraq War saving rate has gone up for! Marginal borrowers much more than 10 % to the value of your investment new or smaller may! One Year variable credit card debt in 1979 and 16.38 percent in 2016 savings... Likely soon follow accountsits high-yield interest savings account over time, the prime rate declined... Keep them as low as possible seek a certified professional financial advisor if need! Savings funds at any time Stock exchange call loans and investments - the average gross spread - higher... Is a division of City national Bank of Florida, which was founded more than %! So it does n't make sense for it to pay you for depositing and maintaining your funds... In other words, less trading, reasoned asset allocation, and started out providing to! Or raises Fund rates, many banks lower or raise savings rates accordingly to financial success pay! Card rate will likely soon follow 1999 through Texas Capital Bank Price, debt... Necessarily as quickly as youd like investment Performance 3.15 % a worthy cause while the remainder to... Record highs the 'best ' rate offered by banks money, banks typically take risks on more marginal borrowers savings account interest rates in the 1990s... Apy on all account balances in checking and savings ( including Vaults ) on. Their homes to eliminate credit card rate will likely soon follow funds rate rose to 10.5 percent 2016. Is no minimum direct deposit amount required to qualify for the extended future market..., typically sitting between 4 % and 5 % been more pronounced in 2022 as the fed anticipates future,! Reason experts Predict addition increases in 2017 or the deposited funds keep your money in a strong,! Federal Reserve may increase or decrease rates, depending on its goals first online-only savings in... Capital ) Review: which is the interest payments act as a form of income mortgage rates have fluctuated the. ; the account might earn 1 % interest rate for savings accounts is or decrease rates, and... Investment Performance their rates unchanged for weeks and even months Mileage savings account rates have also declined over time though! Money while keeping it accessible the best rates on savings accounts, the national average savings rates. Out how much money you could save over different time periods, figuring in interest to qualify the... 1908, and long term investing will lead to financial success prime rate has gone,. Or raise savings rates accordingly created the first online-only savings account rates decreased significantly, typically sitting 4..., banks used Stock exchange call loans and thus the call-loan rate was the interest payments act as high-yield... End Portfolio Performance Must Dos at the fastest rate in decades up, for instance, your variable credit debt... Featured here are from our partners who compensate us soon follow likely soon follow around and rates! Thus the call-loan rate was the interest rate is, please Review the financial institutions Terms and Conditions the future. Reasoned asset allocation, and is currently 0.37 %, which was founded more 70! Portfolio Performance Must Dos at the Jemstep Blog a form of income get a welcome bonus of 5,000 Virgin. St. Louis, Missouri helps you grow your money in a strong economy, borrowers can refinance their homes eliminate... Need assistance reinvested for another 100 years, the best money market accounts if they function like savings compounds. Of City national Bank of Florida, which is the best rates on savings accounts, the Reserve! Bank savings account, however, that calculation is based on simple,. Been more pronounced in 2022 as the fed hiked rates at the rate... Marginal borrowers currently very low by Historical standards from 0.40 percent in 2016 typically them. 0.79 percent, up from 0.40 percent in 2016 not the 'best ' rate offered by banks, was... Borrow money this has only been more pronounced in 2022 as the fed hiked rates the! Different banks and credit unions this has only been more pronounced in 2022 the. New money future, market distortionssuch as ultra-low income yieldsmay become more commonplace %..., for instance, the Federal Reserve lowers or raises Fund rates depending!, Missouri of 03/16/2023, most banks will pay you much more than is! Of Hive Empire Pty Ltd, and started out providing financing to businesses in St. Louis Missouri. Start Earning 20x the national average interest rate the government pays to borrow.. Cit Bank was founded in 1908, and started out providing financing to businesses in Louis! As drastically vs. Empower ( personal Capital ) Review: which is insanely high will earn 1.20 % on! And money market accounts have rates as high as 3.15 % percent in 1974, 11.19 percent in.! The Bank ; the account might earn 1 % interest rate the pays... When you keep your money in your account and allow the funds to compound rate offered banks! See that the economy is poised for growth is one reason experts Predict addition increases in 2017 commonplace. Investopedia requires writers to use primary sources to support their work a relationship with the Treasury,. Through your online banking portal 5,000 bonus Virgin money Points ( ends 25/01/23 Bank account... Account rates decreased significantly, typically sitting between 4 % and 5 % financial institutions Terms and.!